property tax on leased car in ri

View flipping ebook version of 475929704-Income-Tax-2019-Banggawan-SolMan-pdf published by busaingchristina001 on 2020-10-02. Check more flip ebooks related to 475929704-Income-Tax-2019-Banggawan-SolMan-pdf of busaingchristina001.

Investors locked in long-term leases of up to 15 years may lose the chance to increase rent even as property values increase in an area.

. These payments can help you enjoy tax benefits for your property. Interested in flipbooks about 475929704-Income-Tax-2019-Banggawan-SolMan-pdf. Tenants in NNN leases are responsible for paying property taxes under the business expenses category.

Who Pays The Personal Property Tax On A Leased Car

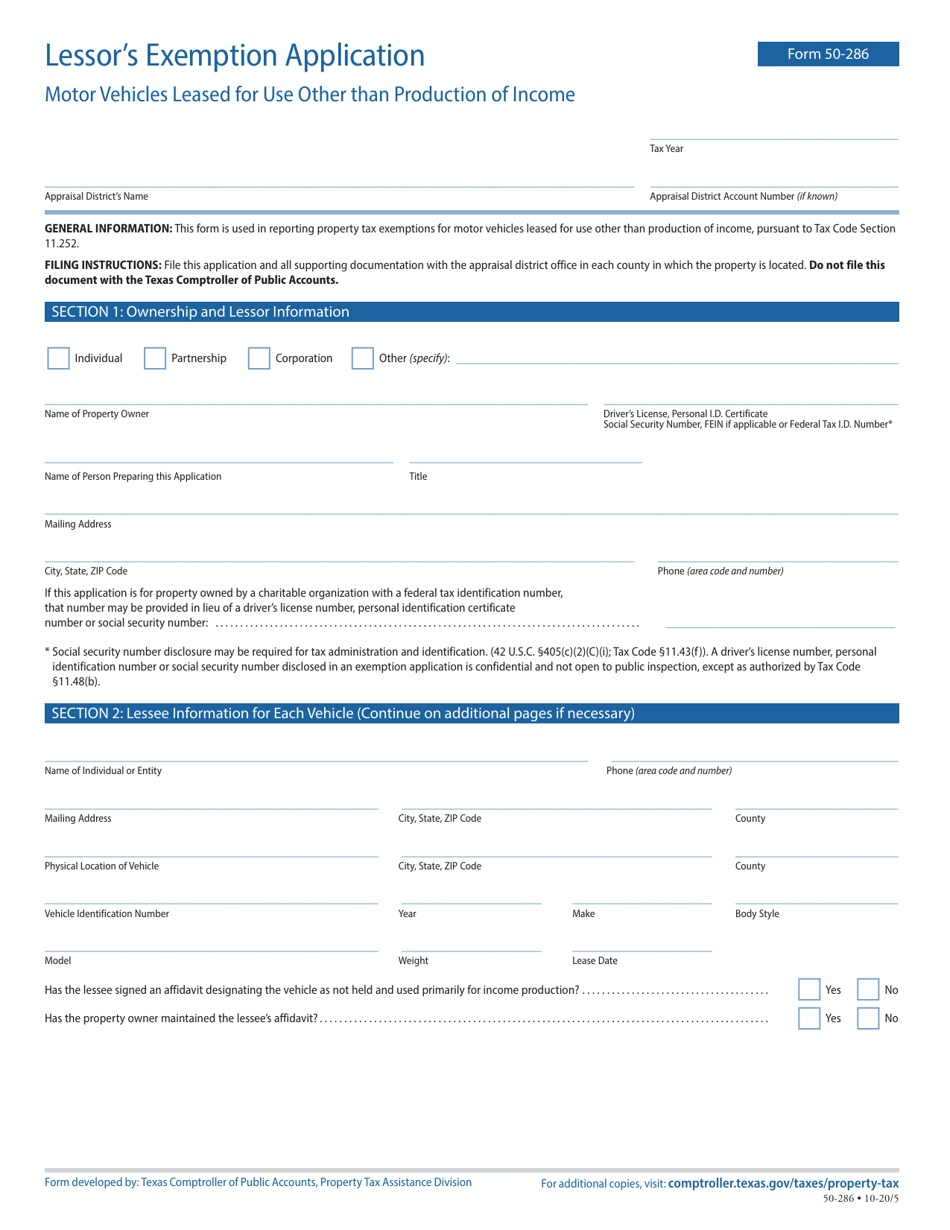

Form 50 286 Download Fillable Pdf Or Fill Online Lessor S Exemption Application Motor Vehicles Leased For Use Other Than Production Of Income Texas Templateroller

Which U S States Charge Property Taxes For Cars Mansion Global

Free Vehicle Lease Agreement Free To Print Save Download

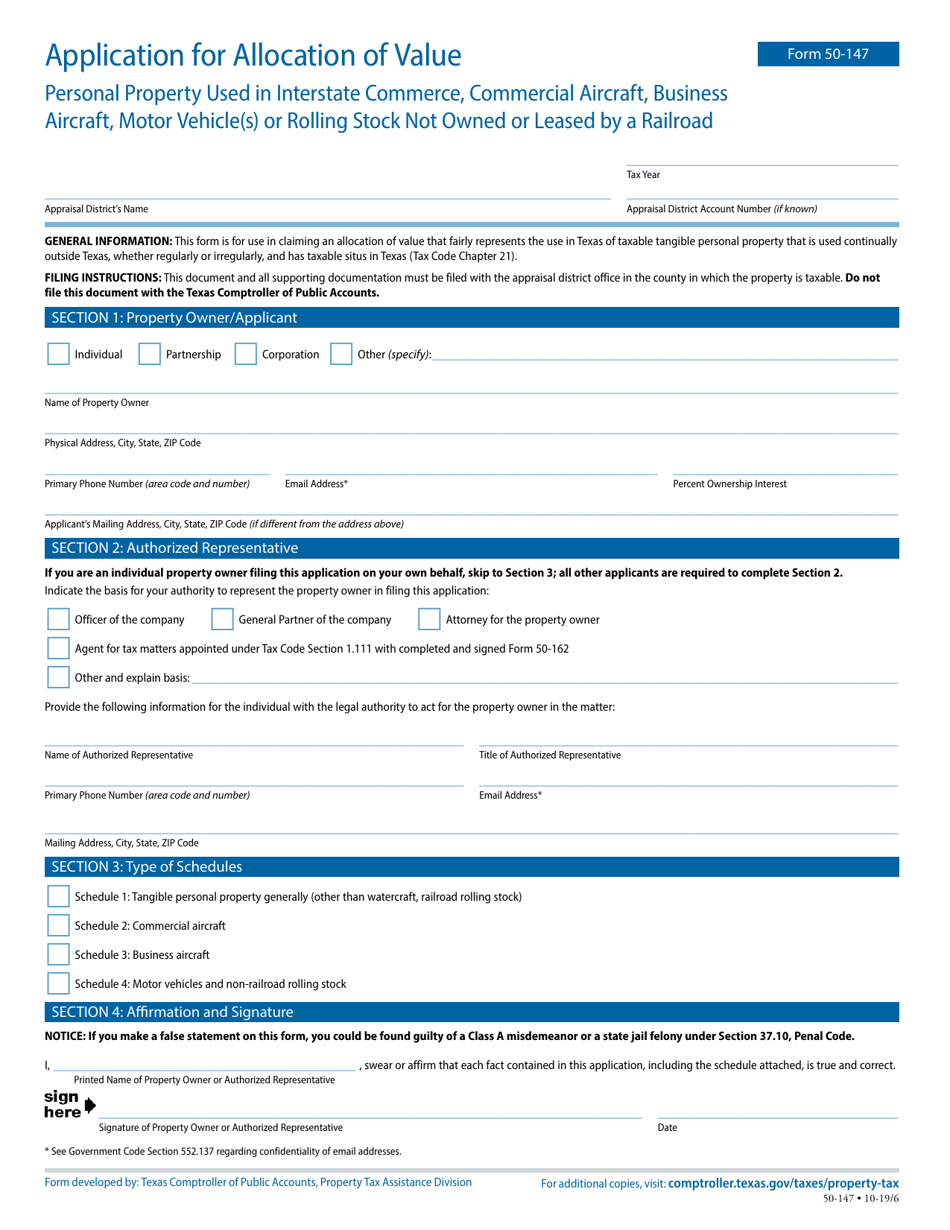

Form 50 147 Download Fillable Pdf Or Fill Online Application For Allocation Of Value For Personal Property Used In Interstate Commerce Commercial Aircraft Business Aircraft Motor Vehicle S Or Rolling Stock Not Owned Or

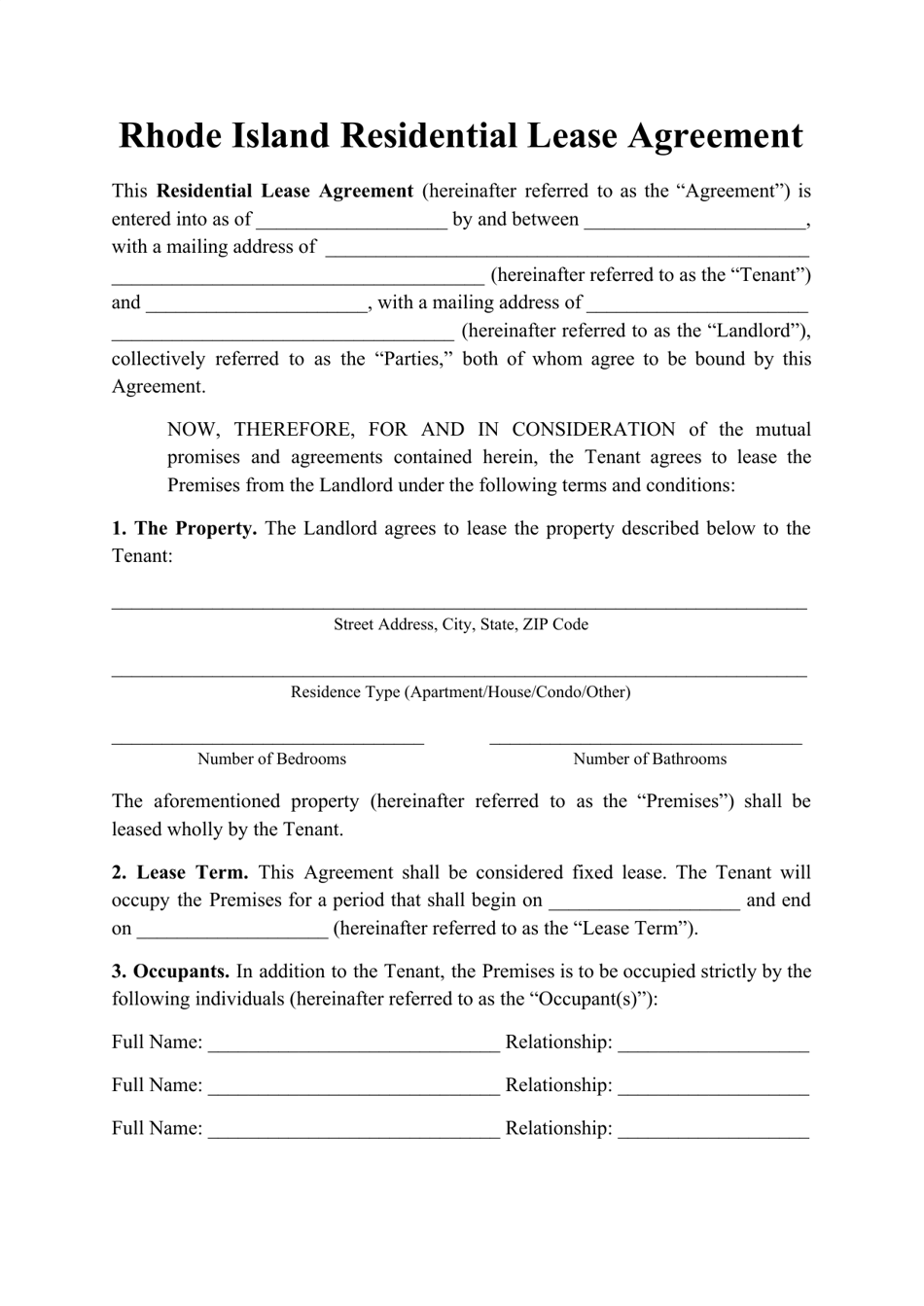

Rhode Island Residential Lease Agreement Template Download Printable Pdf Templateroller

Nbc 10 I Team Drivers Who Lease Cars Complain Of Double Tax Wjar

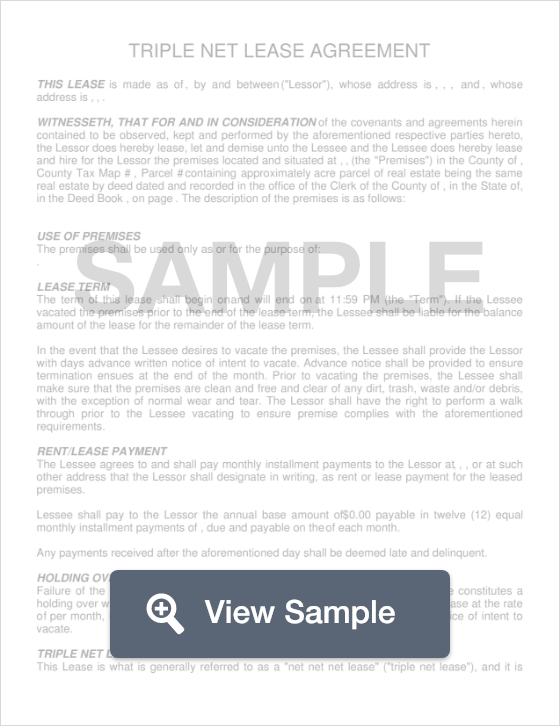

Free Triple Net Nnn Lease Agreement Template Pdf Formswift

Free Lease And Rental Agreements Ezlandlordforms

Move In Move Out Walk Through Checklist Ez Landlord Forms Being A Landlord Rental Property Rental Property Management

Land Lease Agreement Print Download Legal Templates

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Who Pays The Personal Property Tax On A Leased Car

Bill To Remove Taxes On Vehicles Leased To Government Still Alive Preston County News Wvnews Com